Social Security International Agreements

Published: 6/26/2022

SSA.tools calculates social security benefits based on a person's earnings record, copy/pasted from ssa.gov. In cases of work abroad, this record may be insufficient to estimate one's benefit.

Since the late 1970's, the United States has established a network of bilateral Social Security agreements that coordinate the U.S. Social Security program with the comparable programs of other countries. International Social Security agreements, often called "Totalization agreements", help fill gaps in benefit protection for workers who have divided their careers between the United States and another country.

The ssa.gov website maintains a full list of all Totalization Agreements.

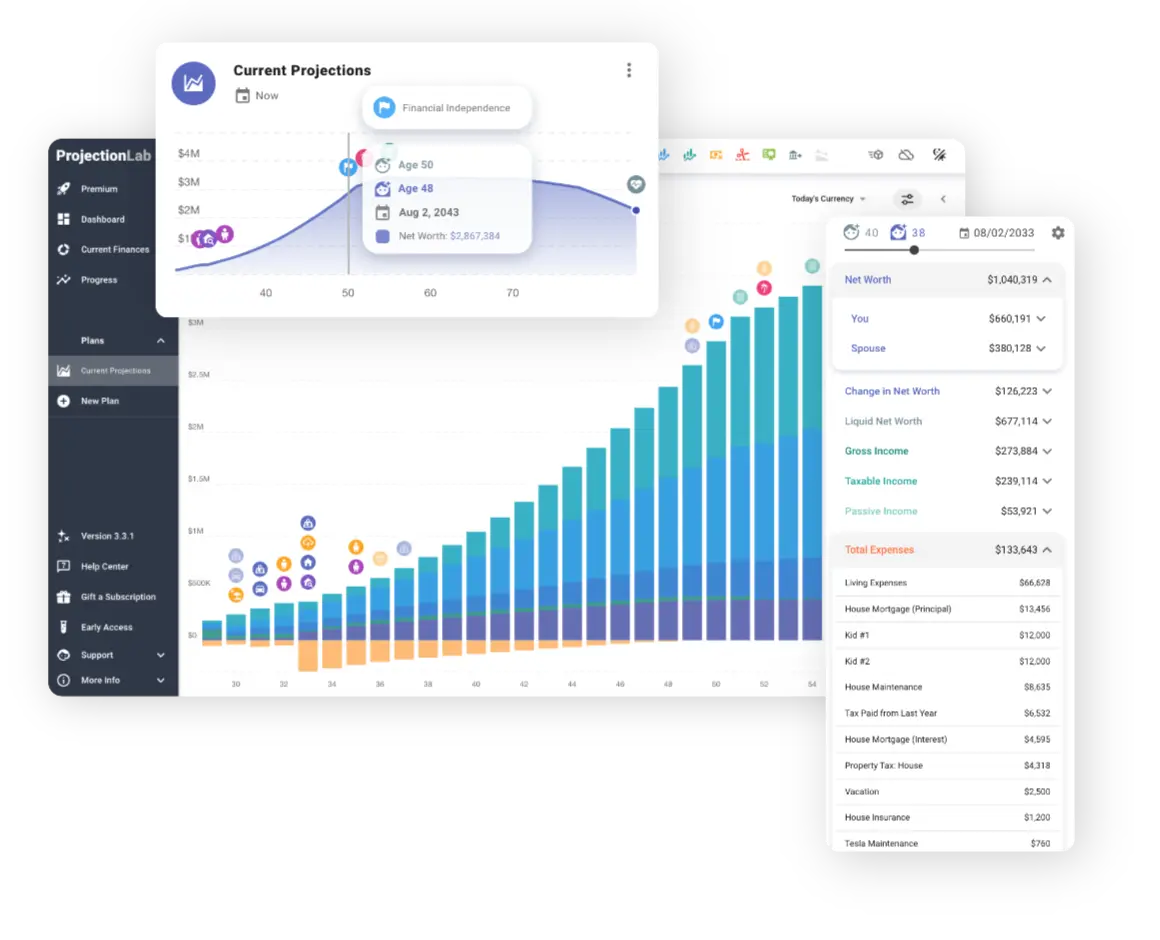

ProjectionLab

Sponsor

ProjectionLab Sponsor

Already optimizing your Social Security? Take your retirement planning to the next level with ProjectionLab, the comprehensive financial modeling platform trusted by serious planners.

- Monte Carlo simulations: Run thousands of market scenarios using 150+ years of historical data to stress-test your plan.

- Advanced modeling: Model complex strategies including Roth conversions, tax-loss harvesting, and dynamic withdrawal rates.

- Professional-grade analytics: Analyze success probabilities, sequence of returns risk, and optimal asset allocation across market cycles.

These agreements allow earned income credits to be earned overseas and still count towards the minimum of 40 credits required for benefits in the US. They also allow for an adjusted benefit based on the amount of time employed in each location.

This website does not provide a way to directly enter overseas earnings nor to compute the related benefits. It should be used as a starting point, but not the final answer, in a case of a multinational career.